VANCOUVER, British Columbia, Jan. 25, 2018 (GLOBE NEWSWIRE) -- Orla Mining Ltd. (TSX VENTURE:OLA) ("Orla" or the "Company") is pleased to announce that it has entered into an agreement to acquire up to a 100% interest in the Monitor Gold exploration project (the “Project”) consisting of 340 claims covering approximately 2,800 hectares in central Nevada. The Project covers zones with silicification and samples with anomalous gold in both Paleozoic carbonate rocks and overlying Tertiary volcanic rocks along a 40 km long belt. The Project features similar Paleozoic stratigraphic formations and silicic Cenozoic volcanic rocks that host large gold deposits elsewhere in Nevada.

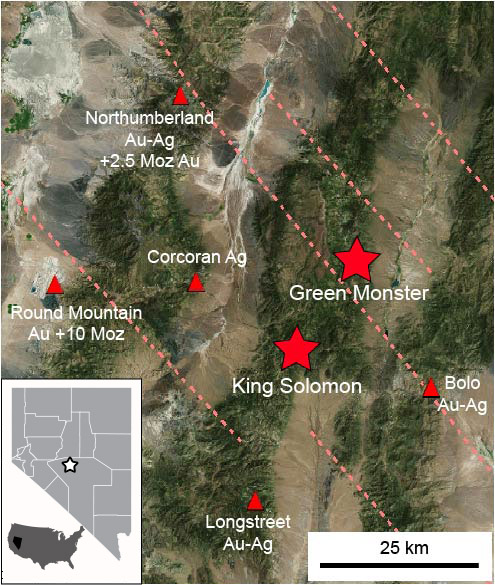

The core of the Project is the King Solomon and Green Monster areas, 80 to 100 km northeast of Tonopah. The Project is 45 km east of the Round Mountain gold deposit, hosted by silicic volcanic rocks (10 million ounce gold production over a 20 year period, according to public disclosure), and 45 km southeast of the sediment-hosted Northumberland Carlin-like gold deposit. Sample results from historic exploration work throughout the Project area show zones of variable silicification with anomalous gold along the west side of a northerly-trending range-front fault. At King Solomon, a total of 96 mostly shallow holes were drilled along a 3.5 km long trend with intercepts from historical reports that feature 67.1 m at 0.5 g/t Au in volcanic rocks and 80.8 m at 0.8 g/t Au in carbonate rocks. At Green Monster, a total of 105 shallow RC drill holes explored a 6 km-long trend of jasperoids in Paleozoic carbonate rocks. Historical reports documented 12 drill holes with intercepts of low-grade gold in silicified carbonate rocks and feature 30 m at 0.80 g/t Au and 49 m at 0.82 g/t Au. The low-grade gold from the historical drilling highlights the potential for mineralization at various stratigraphic levels in both carbonate and volcanic rocks. While many holes reportedly did not intersect significant gold mineralization, potential structural zones and favorable stratigraphic horizons below the shallow holes were never tested.

Marc Prefontaine, the President and Chief Executive Officer stated, “The primary focus for Orla is to secure and develop advanced gold projects. But we always consider any precious metal opportunity that has potential to significantly enhance shareholder value. Our exploration team determined that the Mountain Gold Project vendor had assembled a very high-quality land package and an extensive data package that included results from various exploration efforts by different companies. This data and the belt had never been amalgamated. In isolation, previous results were not significant enough for past operators to justify continued exploration on their land packages. But when looking at the combined areas and data, we believe a very compelling exploration story is apparent. We are excited to have an opportunity in Nevada, one of the premier gold locales in the world. Work in 2018 will include additional data compilation and analysis, geology, surface sampling and geophysics. The goal is to identify drill targets by the end of the year.”

The agreement is structured as a lease between the vendor, Mountain Gold Claims LLC (“Mountain Gold”), a privately held Nevada company, Orla and Monitor Gold Corporation, a wholly owned subsidiary of Orla. The agreement covers an initial 340 claims and is subject to a surrounding area of interest (the “AOI”) in which any additional mineral claims Orla acquires will become part of the lease and a right for Orla to acquire ownership of any claims required to develop a mining operation. Mountain Gold retains a 3% Net Smelter Royalty (“NSR”) covering the claims and any new claims in the AOI, with Orla having the right to purchase a portion of this NSR and a right of first refusal on the remaining portion.

The Project claims are on lands administered by the US Forest Service and the Bureau of Land Management. Access is by maintained gravel roads, with King Solomon approximately 50 km from a paved highway.

Pursuant to the terms of the agreement, Orla is required to make an advanced royalty payment of US$5,000 on execution of the agreement, and advanced royalty payments in the aggregate amount of US$525,000, as allocated per year in the agreement until the 10th anniversary date, and US$100,000 on the 11th anniversary date and each anniversary date thereafter. Orla has annual work commitments in the aggregate of US$155,000 for the first four years of the lease, and US$100,000 for the fifth year and each year thereafter. In addition, Orla will be required to make payments of US$50,000, US$150,000 and US$250,000, on each of the first, third and fifth anniversary dates, respectively, with such payments to be satisfied in cash or through the issuance of common shares of Orla, which shares will be issued at a price based on the closing price of the common shares of Orla on the TSX Venture Exchange on the date prior to the applicable anniversary date or such other price as may be required by the TSX Venture Exchange.

All securities issued in connection with the property option will be subject to a four-month-and-one-day statutory hold period. The agreement remains subject to the approval of the TSX Venture Exchange.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Hans Smit, P.Geo., Chief Operating Officer of Orla Mining Ltd., who is the Qualified Person for the technical information in this news release under NI 43-101 standards.

On behalf of the Board of Directors,

Marc Prefontaine, M.Sc., P.Geo., President & Chief Executive Officer

About Orla Mining Ltd.

Orla Mining owns two advanced stage open pit, heap leach style oxide gold projects in Panama and Mexico. Camino Rojo is an advanced gold and silver project covering over 200,000 hectares in Zacatecas State, Central Mexico. The project is 100% owned and has historical oxide reserves along with historical sulphide resources (which Golcorp retains a back-in right on the sulphides). The Company believes it has exploration potential for additional oxide and sulphide mineral resources. Access and infrastructure are excellent with a paved highway and powerline nearby. A NI 43-101 Technical Report on Camino Rojo is available on SEDAR under the profile of Canplats Resources Corporation (acquired by Goldcorp in 2010). The 100% owned Cerro Quema project in Panama includes a near-term gold production scenario and exploration upside. Cerro Quema's 14,800 Ha concession boasts paved road access, a supportive local population and private land ownership. The Cerro Quema project is currently in the last stage of the permitting process for a proposed open pit mine and gold heap leach operation. Please refer to the Cerro Quema Project - Pre-feasibility Study on the La Pava and Quemita Oxide Gold Deposits dated August 22, 2014, which is available on SEDAR.

Forward-looking Statements

This news release contains certain “forward-looking statements” within the meaning of Canadian and United States securities legislation, including, without limitation, statements with respect to the anticipated terms of the agreement with respect to the Project, the potential for gold mineralization on the Project, results of exploration and planned exploration programs, the potential for discovery of additional mineral resources and the Company's objectives and strategies. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements are discussed in this news release, including without limitation, assumptions that the Company's activities will be in accordance with the Company's public statements and stated goals; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of preliminary economic assessments, drill results and the estimation of mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

For further information, please contact:

Marc Prefontaine

President & Chief Executive Officer