Corporate

Environmental, Social, and Governance (ESG)

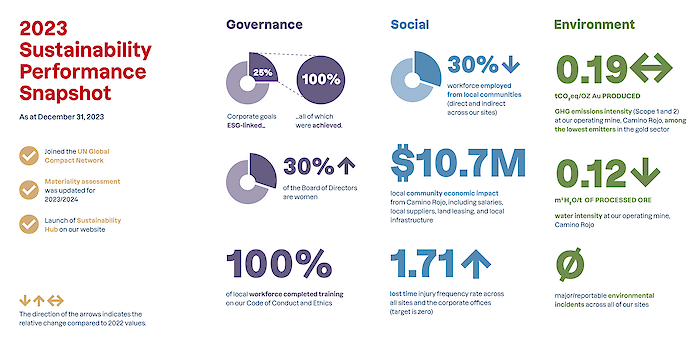

Orla’s commitment to sustainability is based upon creating a net positive benefit for our stakeholders.

Our ESG Goal and Pillars

The strategy is rooted in our business purpose to transform mineral resources into a net positive outcome for all stakeholders. Integrating sustainability into our business purpose means that every member of the Orla team and our partners is committed to the journey toward achieving a net positive impact. It revolves around the objective of contributing more to society than we take from it.

Our strategy, developed with input from multiple stakeholders, has three pillars:

- Maximize benefit to stakeholders

- Minimize injuries, consumption and impacts

- Manage our stakeholder relations with care

In each of these pillars, we have set clear metrics, key performance indicators (KPIs), action plans and timelines to drive progress.

This past year we protected our people, operated without interruption, distributed wide-reaching benefits, and worked to improve the sustainability of the Company.

Message from Orla's Leadership Team

Executive Summaries

2022 Sustainability Report