VANCOUVER, BC – August 3, 2021 - Orla Mining Ltd. (TSX: OLA; NYSE: ORLA) (“Orla” or the "Company") is pleased to provide the results from the oriented in-fill core drilling program on its Camino Rojo sulphide deposit (the “Sulphide Project” or “Camino Rojo Sulphides”), located in Zacatecas, Mexico. The drill results confirm the presence of wide, higher-grade gold zones within the sulphide mineral resource, and the Company intends to further explore the potential for open pit or underground bulk mining methods. An updated resource estimate for the sulphide portion of the deposit will be undertaken which will form the basis of a Preliminary Economic Assessment (the “PEA”).

“We are encouraged with the results from the Camino Rojo Sulphides drill program. While the geological setting is already well understood, this new information will be meaningful as we refine the geological model and move to focus on possible development approaches,” stated Jason Simpson, President and Chief Executive Officer of Orla Mining. “We are pleased that this drilling has reinforced the structural controls predicted by our geologists, and we will likely require more drilling across the orebody, ideally at this more optimal drill orientation.”

SULPHIDE DRILL HIGHLIGHTS:

The program consisted of close-spaced drilling on three sections of the sulphide zone focusing on the extension of the Camino Rojo deposit down plunge of the planned open pit. The objective was to test the continuity of higher-grade mineralization within the 7.3 million ounces of gold in the sulphide measured and indicated mineral resource estimate (259 million tonnes at 0.88 g/t Au)[1] lying directly below the open pit currently being developed on the oxide mineral reserves. The fourteen holes completed across the sulphide zone yielded 27 significant mineralized drill intercepts[2] with a grade-by-thickness factor greater than 50 g/t by metre Au (g/t*m Au), including the following 10 intercepts with a grade-by-thickness factor greater than 100 g/t by metre Au:

- Hole CRSX20-01: 2.38 g/t Au over 108.0m (from 445.0m to 553.0m)

- Hole CRSX20-01A: 2.63 g/t Au over 111.0m (from 449.5m to 560.5m)

- Hole CRSX20-01B: 2.51 g/t Au over 58.5m (from 428.5m to 487.0m)

- Hole CRSX20-01C: 2.11 g/t Au over 115.5m (from 438.0m to 553.5m)

- Hole CRSX20-01D: 3.04 g/t Au over 64.6m (from 515.8m to 580.4m)

- Hole CRSX21-04A: 4.47 g/t Au over 55.5m (from 606.0m to 661.5m)

- Hole CRSX21-04A: 4.95 g/t Au over 55.5m (from 676.5m to 732.0m)

- Hole CRSX21-04B: 2.10 g/t Au over 58.5m (from 530.0m to 588.5m)

- Hole CRSX21-04B: 2.27 g/t Au over 87.0m (from 609.5m to 696.5m)

- Hole CRSX21-04C: 3.26 g/t Au over 44.7m (from 740.3m to 785.0m)

Full drill results are available in the Appendix of the press release and available on Orla’s website at: Sulphide Drill Results.

All assays were performed on 1.5 metre core intervals and all drill core is HQ in diameter in size. The reported composites were not subject to “capping”, however a preliminary analysis suggests that only 2 out of 2,441 samples exceeded the potential capping level of 27.0 g/t - these samples averaged 36.8 g/t gold (max. 42.4 g/t) and Orla believes that applying a top cut would have a negligible effect on overall grades.

SULPHIDE DRILL PROGRAM:

At the time Orla acquired the Camino Rojo project from Goldcorp Inc. (now called Newmont Corporation) in 2017, the Company’s technical team believed, based on its geological evaluation of the existing data, that additional drilling had the potential to outline and better define continuous zones with grades appreciably higher than the average sulphide mineralized measured and indicated mineral resource grade of 0.88 g/t gold. In particular, the Company noted that the vast majority of the drill holes testing the Camino Rojo sulphide zone had been drilled south to north. With many of the key, higher grade sulphide veins being north dipping, this resulted in drill holes intersecting the mineralized zones at a highly oblique angle. The Goldcorp drilling had strongly suggested the presence of higher-grade zones, but the paucity of appropriately oriented intercepts made it difficult to establish the geometry of high-grade domains and to estimate tenor of the better grade mineralization. As a result, the Company concluded that, to further its evaluation of the potential mining scenarios for the Camino Rojo Sulphides, additional drill data would be required to provide confirmation of grade and geometry of the better grade zones. Orla’s 2020-2021 program of southerly directed drill holes was specifically designed to be a step in that process.

The 6,079-metre directional core drilling program on the Camino Rojo sulphide mineral resource began in October 2020 and was completed in April 2021. The main objectives of the program were to generate additional geological and analytical information regarding the continuity and geometry of the higher-grade gold mineralization (>2 g/t Au), obtain geotechnical information required to evaluate potential underground mining scenarios, and provide new material for metallurgical studies. The drill program achieved all objectives, and the information will further support development scenario planning for the large sulphide mineral resource.

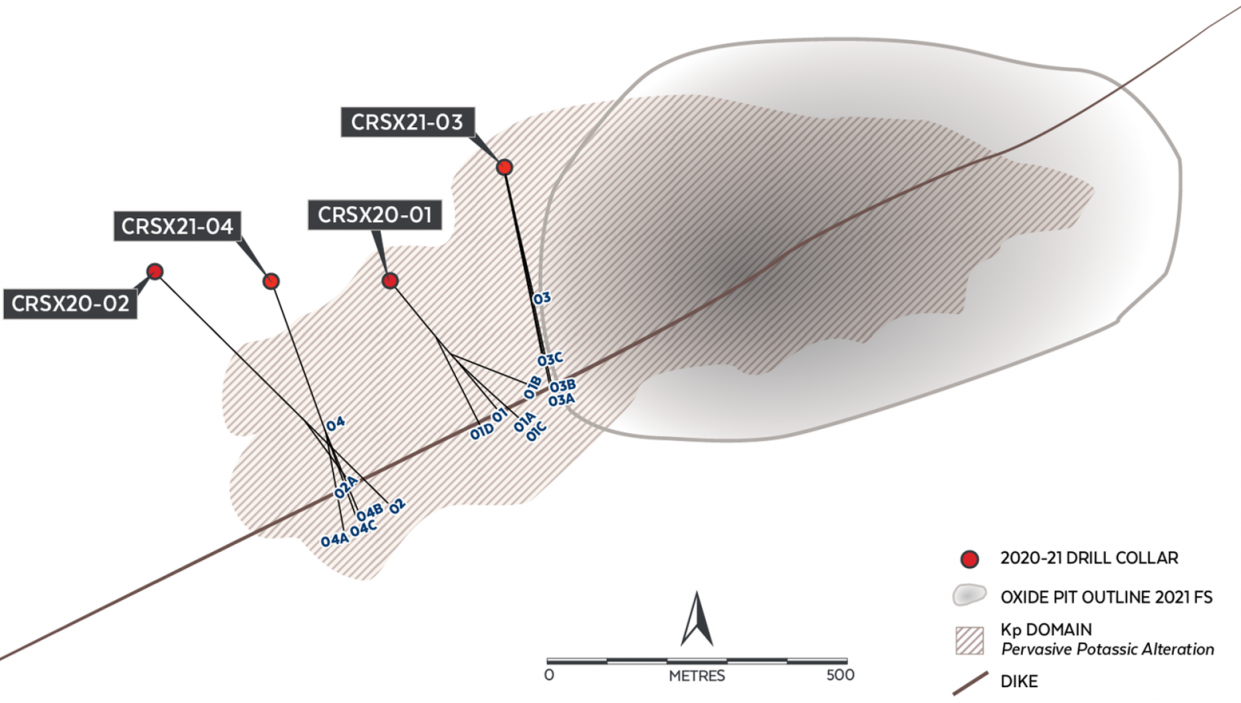

Within the sulphide zone of the Camino Rojo deposit, a total of 14 drill intercepts, including two partial intercepts through the target zones, from four parent holes, were obtained on three sections spaced approximately 250 metres apart (see Figure 1). This program utilized directional drilling techniques, providing closely spaced intercepts ranging from 10 metres to 50 metres on average in the target zone, while avoiding redrilling the upper portions of the holes located in the barren to low grade hanging wall of the deposit. All drill holes were oriented to the southeast targeting a dike fault zone and sulphide vein sets, which dips steeply to the northwest and has been interpreted as a key control of mineralization.

The drill holes yielded multiple wide mineralized intercepts from closely spaced drill holes on each of the widely spaced drill sections. The mineralization consists of swarms of bedding concordant and crosscutting sulphide veinlets hosted by sedimentary rock units (siltstones) of the Caracol Formation.

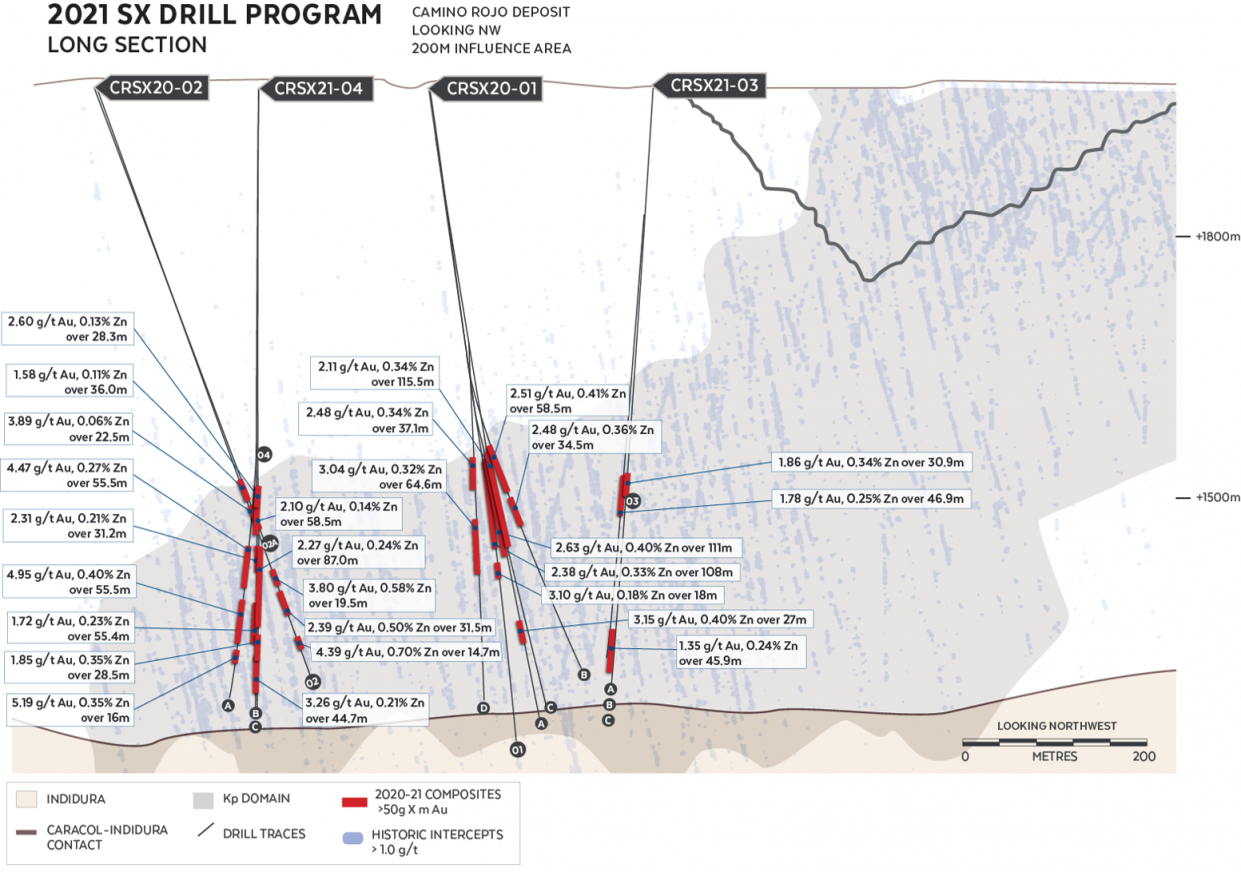

The most significant results with grade-per-thickness factor greater than 50 g/t by metre Au (g/t*m Au) are tabulated below and shown on a vertical longitudinal section (see Figure 2). Full results are available in the Appendix.

Holeid | From_m | To_m | metres | Au g/t | g/t*m Au | Zn% |

CRSX20-01 | 445.0 | 553.0 | 108.0 | 2.38 | 257 | 0.33 |

CRSX20-01 | 563.5 | 581.5 | 18.0 | 3.10 | 56 | 0.18 |

CRSX20-01A | 449.5 | 560.5 | 111.0 | 2.63 | 292 | 0.40 |

CRSX20-01A | 638.5 | 665.5 | 27.0 | 3.15 | 85 | 0.40 |

CRSX20-01B | 428.5 | 487.0 | 58.5 | 2.51 | 147 | 0.41 |

CRSX20-01B | 494.5 | 529.0 | 34.5 | 2.48 | 86 | 0.36 |

CRSX20-01C | 438.0 | 553.5 | 115.5 | 2.11 | 243 | 0.34 |

CRSX20-01D | 442.0 | 479.1 | 37.1 | 2.48 | 92 | 0.34 |

CRSX20-01D | 515.8 | 580.4 | 64.6 | 3.04 | 196 | 0.32 |

CRSX20-02 | 711.0 | 730.5 | 19.5 | 3.80 | 74 | 0.58 |

CRSX20-02 | 741.0 | 772.5 | 31.5 | 2.39 | 75 | 0.50 |

CRSX20-02 | 805.5 | 820.2 | 14.7 | 4.39 | 65 | 0.70 |

CRSX20-02A | 607.0 | 643.0 | 36.0 | 1.58 | 57 | 0.11 |

CRSX20-02A | 691.0 | 713.5 | 22.5 | 3.89 | 88 | 0.06 |

CRSX21-03 | 481.5 | 512.4 | 30.9 | 1.86 | 57 | 0.34 |

CRSX21-03C | 491.3 | 538.2 | 46.9 | 1.78 | 84 | 0.25 |

CRSX21-03C | 681.1 | 727.0 | 45.9 | 1.35 | 62 | 0.24 |

CRSX21-04A | 606.0 | 661.5 | 55.5 | 4.47 | 248 | 0.27 |

CRSX21-04A | 676.5 | 732.0 | 55.5 | 4.95 | 275 | 0.40 |

CRSX21-04A | 741.5 | 757.5 | 16.0 | 5.19 | 83 | 0.35 |

CRSX21-04B | 530.0 | 588.5 | 58.5 | 2.10 | 123 | 0.14 |

CRSX21-04B | 609.5 | 696.5 | 87.0 | 2.27 | 197 | 0.24 |

CRSX21-04B | 713.0 | 741.5 | 28.5 | 1.85 | 53 | 0.35 |

CRSX21-04C | 529.0 | 557.3 | 28.3 | 2.60 | 73 | 0.13 |

CRSX21-04C | 607.0 | 638.2 | 31.2 | 2.31 | 72 | 0.21 |

CRSX21-04C | 677.0 | 732.4 | 55.4 | 1.72 | 95 | 0.23 |

CRSX21-04C | 740.3 | 785.0 | 44.7 | 3.26 | 145 | 0.21 |

Holes CRSX21-03A and CRSX21-03B returned significant intercepts but below 50 g/t by metre Au, including 27.9m at 1.34 g/t Au, 10.5m at 2.47 g/t Au, 25.5m at 1.07 g/t Au in hole CRSX21-03A, and 7.5m at 4.0 g/t Au, 7.5m at 2.94 g/t Au, 25m at 1.42 g/t Au and 16m at 1.26 g/t Au in hole CRSX21-03B. Hole CRSX21-04 was the parent hole and was not completed to depth needed to hit target and was not sampled, but daughter holes 04A, 04B, and 04C were drilled through the zone.

Figure 1: Plan View of 2020-2021 Camino Rojo Sulphide Project Drill Holes

Figure 2: Longitudinal Section showing most significant intercepts (greater than 50 g/t by metre Au) of 2020-2021 Camino Rojo Sulphide Project Drill Holes

This new drilling was intended to test a refined geological model and to further assess and confirm the presence of higher-grade zones. The recent holes drilled more perpendicular to the structure and across the steeply dipping sulphide vein sets, appear to confirm the presence of the higher-grade portions of the deposit.

Additional drill sections are available on Orla’s website at: Sulphide Drill Sections.

CAMINO ROJO SULPHIDE PROJECT:

In parallel with advancement of the Camino Rojo Oxide Gold Project towards first production by the end of 2021, the Company is also evaluating multiple development scenarios on the Camino Rojo Sulphide Project. The development scenarios being considered to potentially form the basis of a PEA currently include: (1) an underground mining option or (2) an open pit mining option with processing at a to-be-constructed sulphide facility at Camino Rojo, and (3) an open pit mining option with processing at Newmont Corporation’s Peñasquito plant.

Orla’s geological team is integrating geological and geotechnical data from the 2020-2021 drill program, including downhole televiewer data, into an updated geological model. Mine Development Associates of Reno, Nevada will then update the sulphide mineral resource estimate, using the updated geological model and all drilling data for the Sulphide Project, including the recent Sulphide Project drill hole data.

The first batch of samples obtained from the drilling has arrived at Blue Coast Research Ltd. of Parksville, British Columbia for metallurgical testing. Investigations will build on the previous metallurgical work completed on the Sulphide Project and will include process methods and updated recovery predictions as well as exploring the potential for ore sorting, which will be completed by Sherritt & Steinert.

Activities for the Sulphide Project in the second half of the year will focus on updating the mineral resource estimate, evaluating economic opportunities, and metallurgical studies. While Orla remains focused on completion of the Camino Rojo sulphide PEA by year end, the higher grades indicated in the recent drill program may necessitate additional drilling and to ensure the resource appropriately reflects the grade and tonnage of the higher-grade zones. The timing of the study may therefore be adjusted.

Drill Results: All reported intercept widths are down hole intervals. Drilled intercepts are believed to be true width intercepts across a broad mineralized zone. Drill results are also available at Sulphide Drill Results.

Qualified Persons Statement

The scientific and technical information related to Camino Rojo in this news release has been reviewed and approved by Mr. Sylvain Guerard, P. Geo., who is the Qualified Person as defined under the definitions of National Instrument 43-101 (“NI 43-101”).

Quality Control Protocols

All gold results were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples were also analyzed for sulphur/sulphide using ME-IR08, carbon and organic carbon using ME-IR06a and multi-elements, including silver, copper, lead and zinc using an Aqua Regia (ME-ICP41) method at ALS Laboratories in Canada. Samples with base metal values in excess of 1% by ICP analysis are re-run with AA46 aqua regia and atomic absorption analysis. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards, blanks and duplicates are included approximately one every 25 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to a secondary laboratory for check assays.

About Orla Mining Ltd.

Orla is developing the Camino Rojo Oxide Gold Project, an advanced gold and silver open-pit and heap leach project, located in Zacatecas State, Central Mexico. The project is 100% owned by Orla and covers over 160,000 hectares. The technical report for the 2021 Feasibility Study entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” dated January 11, 2021, is available on SEDAR and EDGAR under the Company's profile at www.sedar.com and www.sec.gov, respectively. The technical report is also available on Orla’s website at www.orlamining.com. Orla also owns 100% of the Cerro Quema Project located in Panama which includes a near-term gold production scenario and various exploration targets. The Cerro Quema Project is a proposed open pit mine and gold heap leach operation and the Company recently announced the highlights of a Pre-Feasibility Study on the project. An independent technical report for the Pre-Feasibility Study on the Cerro Quema Oxide Gold Project prepared in accordance with the requirements of NI 43-101 will be available under Orla’s profile on SEDAR, EDGAR, and on the Company’s website on or before September 11, 2021.

For further information, please contact:

Jason Simpson

President & Chief Executive Officer

Andrew Bradbury

Director, Investor Relations

www.orlamining.com

info@orlamining.com

Forward-looking Statements

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation and within the meaning of Section 27A of the United States Securities Act of 1933, as amended, Section 21E of the United States Exchange Act of 1934, as amended, the United States Private Securities Litigation Reform Act of 1995, or in releases made by the United States Securities and Exchange Commission, all as may be amended from time to time, including, without limitation, statements with respect to the Company’s construction, operation, and exploration of projects, as well as its objectives and strategies, including the timing of the updated mineral resource and PEA on the Sulphide Project, the results of the drill program and future exploration work at the Sulphide Project. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of feasibility studies, pre-feasibility studies, and preliminary economic assessments, including but not limited to, assumptions underlying the production estimates not being realized, changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral reserves and mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated March 29, 2021, available on www.sedar.com and www.sec.gov. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

Cautionary Note to U.S. Readers

We prepare our financial statements, which are incorporated by reference herein, in United States dollars and in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board which differs from US generally accepted accounting principles (“US GAAP”) in certain material respects, and thus are not directly comparable to financial statements prepared in accordance with US GAAP.

The disclosure in this release uses mineral reserve and mineral resource classification terms that comply with reporting standards in Canada, and mineral reserve and mineral resource estimates are made in accordance with Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Definition Standards”). These standards differ significantly from the mineral reserve disclosure requirements of the United States Securities Exchange Commission (the “SEC”) set forth in Industry Guide 7. Consequently, information regarding mineralization contained in this release is not comparable to similar information that would generally be disclosed by U.S. companies in accordance with the rules of the SEC. In particular, the SEC’s Industry Guide 7 applies different standards in order to classify mineralization as a reserve. Accordingly, mineral reserve estimates contained or referenced in this release may not qualify as “reserves” under SEC standards. In addition, this release uses the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral resources” to comply with the reporting standards in Canada. The SEC does not currently recognize mineral resources and U.S. companies are generally not permitted to disclose mineral resources of any category in documents they file with the SEC. Investors are specifically cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into mineral reserves as defined in NI 43-101 or Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an inferred resource could ever be mined economically. It cannot be assumed that all or any part of “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the reported “measured mineral resources,” “indicated mineral resources,” or “inferred mineral resources” in this release is economically or legally mineable. The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Securities Exchange Act of 1934 (“Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) but as a foreign private issuer that files its annual report on Form 40-F with the SEC pursuant to the multi-jurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101. Investors are specifically cautioned that there are also significant differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” or other measures under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules. For the above reasons, information contained in this presentation containing descriptions of our mineral reserve and mineral resource estimates is not comparable to similar information made public by U.S. companies subject to reporting and disclosure requirements of the SEC under either Industry Guide 7 or SEC Modernization Rules.

Appendix: Camino Rojo Sulphide Drill Results[3]

Holeid | Inc | From_m | To_m | meters | Au g/t | g/t *m Au | Zn% | e_nad27 | n_nad27 | elev_mts | azimuth | dip | metres |

CRSX20-01 | 445.0 | 553.0 | 108.0 | 2.38 | 257 | 0.33 | 243704 | 2676087 | 1952 | 138.3 | -65.6 | 761.5 | |

CRSX20-01 | Incl. | 500.5 | 502.0 | 1.5 | 12.50 | 19 | 0.92 | ||||||

CRSX20-01 | 563.5 | 581.5 | 18.0 | 3.10 | 56 | 0.18 | |||||||

CRSX20-01 | Incl. | 566.5 | 568.0 | 1.5 | 13.30 | 20 | 0.22 | ||||||

CRSX20-01 | 601.0 | 610.0 | 9.0 | 3.42 | 31 | 0.18 | |||||||

CRSX20-01 | 628.0 | 643.0 | 15.0 | 1.51 | 23 | 0.19 | |||||||

CRSX20-01 | 661.1 | 694.0 | 33.0 | 1.21 | 40 | 0.27 | |||||||

CRSX20-01A | 449.5 | 560.5 | 111.0 | 2.63 | 292 | 0.40 | 243704 | 2676087 | 1952 | 134.7 | -64.8 | 349.5 | |

CRSX20-01A | Incl. | 478.0 | 479.5 | 1.5 | 11.10 | 17 | 0.27 | ||||||

CRSX20-01A | Incl. | 481.0 | 482.5 | 1.5 | 12.80 | 19 | 5.94 | ||||||

CRSX20-01A | Incl. | 502.0 | 503.5 | 1.5 | 10.75 | 16 | 1.89 | ||||||

CRSX20-01A | Incl. | 559.0 | 560.5 | 1.5 | 15.80 | 24 | 0.29 | ||||||

CRSX20-01A | 570.8 | 586.0 | 15.2 | 1.27 | 19 | 0.27 | |||||||

CRSX20-01A | 604.0 | 619.0 | 15.0 | 1.95 | 29 | 0.16 | |||||||

CRSX20-01A | 638.5 | 665.5 | 27.0 | 3.15 | 85 | 0.40 | |||||||

CRSX20-01A | Incl. | 650.7 | 653.5 | 2.8 | 12.48 | 35 | 0.54 | ||||||

CRSX20-01A | Incl. | 662.5 | 664.0 | 1.5 | 10.00 | 15 | 0.12 | ||||||

CRSX20-01A | 674.5 | 682.0 | 7.5 | 2.56 | 19 | 0.42 | |||||||

CRSX20-01B | 428.5 | 487.0 | 58.5 | 2.51 | 147 | 0.41 | 243704 | 2676087 | 1952 | 110.5 | -61.6 | 336.0 | |

CRSX20-01B | 494.5 | 529.0 | 34.5 | 2.48 | 86 | 0.36 | |||||||

CRSX20-01B | 539.5 | 545.5 | 6.0 | 2.45 | 15 | 0.15 | |||||||

CRSX20-01B | 556.0 | 571.0 | 15.0 | 2.26 | 34 | 0.52 | |||||||

CRSX20-01B | 583.0 | 592.0 | 9.0 | 2.08 | 19 | 0.45 | |||||||

CRSX20-01B | 620.5 | 631.0 | 10.5 | 3.50 | 37 | 0.07 | |||||||

CRSX20-01B | Incl. | 628.0 | 629.5 | 1.5 | 10.10 | 15 | 0.11 | ||||||

CRSX20-01B | 650.5 | 677.5 | 27.0 | 1.10 | 30 | 0.26 | |||||||

CRSX20-01C | 412.7 | 430.5 | 17.8 | 1.33 | 24 | 0.42 | 243704 | 2676087 | 1952 | 133.1 | -64.2 | 421.8 | |

CRSX20-01C | 438.0 | 553.5 | 115.5 | 2.11 | 243 | 0.34 | |||||||

CRSX20-01C | Incl. | 480.0 | 481.5 | 1.5 | 14.20 | 21 | 2.31 | ||||||

CRSX20-01C | Incl. | 490.5 | 492.0 | 1.5 | 11.90 | 18 | 0.52 | ||||||

CRSX20-01C | Incl. | 547.5 | 549.0 | 1.5 | 18.75 | 28 | 0.15 | ||||||

CRSX20-01C | 562.5 | 571.5 | 9.0 | 1.57 | 14 | 0.11 | |||||||

CRSX20-01C | 592.0 | 605.5 | 13.5 | 2.24 | 30 | 0.06 | |||||||

CRSX20-01C | 631.0 | 635.5 | 4.5 | 4.45 | 20 | 0.19 | |||||||

CRSX20-01C | 643.0 | 659.5 | 16.5 | 1.29 | 21 | 0.40 | |||||||

CRSX20-01D | 425.5 | 433.0 | 7.5 | 3.56 | 27 | 0.82 | 243704 | 2676087 | 1952 | 152.8 | -67.1 | 470.5 | |

CRSX20-01D | 442.0 | 479.1 | 37.1 | 2.48 | 92 | 0.34 | |||||||

CRSX20-01D | Incl. | 477.7 | 479.1 | 1.4 | 20.30 | 28 | 0.87 | ||||||

CRSX20-01D | 496.4 | 501.0 | 4.6 | 6.15 | 28 | 1.31 | |||||||

CRSX20-01D | Incl. | 499.5 | 501.0 | 1.5 | 16.30 | 24 | 3.70 | ||||||

CRSX20-01D | 515.8 | 580.4 | 64.6 | 3.04 | 196 | 0.32 | |||||||

CRSX20-01D | Incl. | 547.0 | 550.0 | 3.0 | 22.20 | 67 | 1.75 | ||||||

CRSX20-01D | Incl. | 578.5 | 580.4 | 1.9 | 12.20 | 23 | 0.50 | ||||||

CRSX20-01D | 586.5 | 594.0 | 7.5 | 4.78 | 36 | 0.40 | |||||||

CRSX20-01D | Incl. | 586.5 | 588.0 | 1.5 | 10.60 | 16 | 1.12 | ||||||

CRSX20-01D | 601.5 | 618.0 | 16.5 | 1.84 | 30 | 0.09 | |||||||

CRSX20-01D | 633.6 | 646.6 | 13.0 | 1.81 | 24 | 0.25 | |||||||

CRSX20-02 | 604.5 | 613.5 | 9.0 | 1.13 | 10 | 0.04 | 243310 | 2676109 | 1957 | 137.1 | -47.4 | 848.7 | |

CRSX20-02 | 624.0 | 646.5 | 22.5 | 1.10 | 25 | 0.08 | |||||||

CRSX20-02 | 654.0 | 667.5 | 13.5 | 1.93 | 26 | 0.18 | |||||||

CRSX20-02 | 685.5 | 702.0 | 16.5 | 2.32 | 38 | 0.12 | |||||||

CRSX20-02 | 711.0 | 730.5 | 19.5 | 3.80 | 74 | 0.58 | |||||||

CRSX20-02 | Incl. | 723.3 | 725.3 | 2.0 | 16.60 | 33 | 2.66 | ||||||

CRSX20-02 | 741.0 | 772.5 | 31.5 | 2.39 | 75 | 0.50 | |||||||

CRSX20-02 | 781.5 | 796.5 | 15.0 | 1.45 | 22 | 0.34 | |||||||

CRSX20-02 | 805.5 | 820.2 | 14.7 | 4.39 | 65 | 0.70 | |||||||

CRSX20-02 | Incl. | 813.0 | 814.5 | 1.5 | 20.70 | 31 | 2.63 | ||||||

CRSX20-02 | 826.5 | 832.5 | 6.0 | 4.45 | 27 | 0.45 | |||||||

CRSX20-02A | 607.0 | 643.0 | 36.0 | 1.58 | 57 | 0.11 | 243310 | 2676109 | 1957 | 145.2 | -53.9 | 246.8 | |

CRSX20-02A | 691.0 | 713.5 | 22.5 | 3.89 | 88 | 0.06 | |||||||

CRSX20-02A | Incl. | 691.0 | 692.5 | 1.5 | 13.30 | 20 | 0.10 | ||||||

CRSX20-02A | Incl. | 698.5 | 700.0 | 1.5 | 16.05 | 24 | 0.24 | ||||||

CRSX20-02A | 722.5 | 730.0 | 7.5 | 2.96 | 22 | 0.61 | |||||||

CRSX21-03 | 434.5 | 436.0 | 1.5 | 26.30 | 39 | 0.22 | 243896 | 2676281 | 1950 | 168.4 | -58.0 | 512.4 | |

CRSX21-03 | 443.5 | 467.5 | 24.0 | 1.94 | 46 | 0.26 | |||||||

CRSX21-03 | 481.5 | 512.4 | 30.9 | 1.86 | 57 | 0.34 | |||||||

CRSX21-03 | Incl. | 496.0 | 497.5 | 1.5 | 19.05 | 29 | 1.21 | ||||||

CRSX21-03A | 500.5 | 528.4 | 27.9 | 1.34 | 37 | 0.25 | 243896 | 2676281 | 1950 | 168.7 | -56.5 | 228.2 | |

CRSX21-03A | 579.0 | 589.5 | 10.5 | 2.47 | 26 | 0.24 | |||||||

CRSX21-03A | 609.0 | 619.5 | 10.5 | 1.48 | 16 | 0.27 | |||||||

CRSX21-03A | 633.0 | 640.5 | 7.5 | 1.81 | 14 | 0.35 | |||||||

CRSX21-03A | 661.5 | 666.5 | 5.0 | 3.77 | 19 | 0.31 | |||||||

CRSX21-03A | Incl. | 665.4 | 666.5 | 1.1 | 11.80 | 14 | 0.15 | ||||||

CRSX21-03A | 675.0 | 689.0 | 14.0 | 1.10 | 15 | 0.17 | |||||||

CRSX21-03A | 699.5 | 725.0 | 25.5 | 1.07 | 27 | 0.21 | |||||||

CRSX21-03B | 495.0 | 502.5 | 7.5 | 4.00 | 30 | 0.40 | 243896 | 2676281 | 1950 | 167.8 | -62.8 | 239.8 | |

CRSX21-03B | Incl. | 501.0 | 502.5 | 1.5 | 16.05 | 24 | 0.39 | ||||||

CRSX21-03B | 509.5 | 512.5 | 3.0 | 3.48 | 10 | 0.55 | |||||||

CRSX21-03B | 521.5 | 529.0 | 7.5 | 1.87 | 14 | 0.17 | |||||||

CRSX21-03B | 614.5 | 620.5 | 6.0 | 2.39 | 14 | 1.00 | |||||||

CRSX21-03B | 638.5 | 646.0 | 7.5 | 2.94 | 22 | 0.32 | |||||||

CRSX21-03B | Incl. | 644.5 | 646.0 | 1.5 | 12.45 | 19 | 0.34 | ||||||

CRSX21-03B | 680.5 | 705.5 | 25.0 | 1.42 | 35 | 0.29 | |||||||

CRSX21-03B | 711.5 | 727.5 | 16.0 | 1.26 | 20 | 0.51 | |||||||

CRSX21-03C | 491.3 | 538.2 | 46.9 | 1.78 | 84 | 0.25 | 243896 | 2676281 | 1950 | 169.2 | -60.5 | 283.3 | |

CRSX21-03C | 562.0 | 563.5 | 1.5 | 6.69 | 10 | 0.12 | |||||||

CRSX21-03C | 681.1 | 727.0 | 45.9 | 1.35 | 62 | 0.24 | |||||||

CRSX21-04A | 548.2 | 562.5 | 14.3 | 2.66 | 38 | 0.07 | 243504 | 2676088 | 1955 | 171.0 | -57.9 | 303.0 | |

CRSX21-04A | 571.5 | 573.0 | 1.5 | 6.91 | 10 | 0.08 | |||||||

CRSX21-04A | 606.0 | 661.5 | 55.5 | 4.47 | 248 | 0.27 | |||||||

CRSX21-04A | Incl. | 617.0 | 618.3 | 1.3 | 12.75 | 17 | 0.05 | ||||||

CRSX21-04A | Incl. | 630.0 | 631.5 | 1.5 | 15.00 | 23 | 0.17 | ||||||

CRSX21-04A | Incl. | 652.5 | 655.5 | 3.0 | 20.63 | 62 | 0.46 | ||||||

CRSX21-04A | 676.5 | 732.0 | 55.5 | 4.95 | 275 | 0.40 | |||||||

CRSX21-04A | Incl. | 714.0 | 715.5 | 1.5 | 42.40 | 64 | 0.92 | ||||||

CRSX21-04A | Incl. | 727.5 | 730.5 | 3.0 | 24.08 | 72 | 0.97 | ||||||

CRSX21-04A | 741.5 | 757.5 | 16.0 | 5.19 | 83 | 0.35 | |||||||

CRSX21-04A | Incl. | 745.4 | 747.0 | 1.6 | 14.90 | 24 | 0.22 | ||||||

CRSX21-04A | Incl. | 754.5 | 756.2 | 1.7 | 17.45 | 30 | 0.15 | ||||||

CRSX21-04A | 775.5 | 777.0 | 1.5 | 6.75 | 10 | 0.05 | |||||||

CRSX21-04B | 530.0 | 588.5 | 58.5 | 2.10 | 123 | 0.14 | 243504 | 2676088 | 1955 | 156.7 | -62.8 | 295.0 | |

CRSX21-04B | Incl. | 534.5 | 536.0 | 1.5 | 16.45 | 25 | 0.12 | ||||||

CRSX21-04B | Incl. | 554.0 | 555.5 | 1.5 | 11.75 | 18 | 0.41 | ||||||

CRSX21-04B | 609.5 | 696.5 | 87.0 | 2.27 | 197 | 0.24 | |||||||

CRSX21-04B | Incl. | 624.4 | 625.4 | 1.0 | 10.10 | 10 | 0.04 | ||||||

CRSX21-04B | Incl. | 692.0 | 693.5 | 1.5 | 10.10 | 15 | 0.17 | ||||||

CRSX21-04B | 713.0 | 741.5 | 28.5 | 1.85 | 53 | 0.35 | |||||||

CRSX21-04B | 749.0 | 766.5 | 17.5 | 1.92 | 34 | 0.61 | |||||||

CRSX21-04B | 780.0 | 796.5 | 16.5 | 2.50 | 41 | 0.17 | |||||||

CRSX21-04B | Incl. | 793.5 | 795.0 | 1.5 | 11.00 | 17 | 0.01 | ||||||

CRSX21-04C | 529.0 | 557.3 | 28.3 | 2.60 | 73 | 0.13 | 243504 | 2676088 | 1955 | 160.5 | -60.0 | 282.0 | |

CRSX21-04C | Incl. | 532.0 | 533.5 | 1.5 | 13.00 | 20 | 0.38 | ||||||

CRSX21-04C | 563.5 | 590.5 | 27.0 | 1.75 | 47 | 0.22 | |||||||

CRSX21-04C | 607.0 | 638.2 | 31.2 | 2.31 | 72 | 0.21 | |||||||

CRSX21-04C | 647.0 | 669.5 | 22.5 | 1.98 | 45 | 0.23 | |||||||

CRSX21-04C | Incl. | 649.7 | 651.0 | 1.3 | 10.85 | 14 | 0.81 | ||||||

CRSX21-04C | 677.0 | 732.4 | 55.4 | 1.72 | 95 | 0.23 | |||||||

CRSX21-04C | 740.3 | 785.0 | 44.7 | 3.26 | 145 | 0.21 | |||||||

CRSX21-04C | Incl. | 747.5 | 749.0 | 1.5 | 12.40 | 19 | 0.54 | ||||||

CRSX21-04C | Incl. | 776.0 | 777.5 | 1.5 | 13.25 | 20 | 0.04 |

[1] The Camino Rojo Mineral Resource estimate has an effective date of June 7, 2019 and was prepared using the CIM Definition Standards. Additional information can be found in the Camino Rojo Technical Report entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” and dated January 11, 2021.

[2] Those intervals deemed significant and listed in the Appendix table were defined and calculated using a cut-off grade of 1 g/t Au, a minimum composite of 10 g/t*m Au, and a maximum 6 metres of consecutive internal waste (<1 g/t Au). Individual assay results or composite results of >10g/t Au (calculated with no internal dilution) are listed in the table.

[3] Daughter hole position is given as the collar location of the parent hole. The reported azimuth and dip of the daughter holes corresponds to the surveyed azimuth and dip at the target (the dike fault zone). Reported azimuth and dip of parent holes is from the initial survey at surface.