VANCOUVER, BRITISH COLUMBIA--(Marketwired - Aug. 24, 2017) - Orla Mining Ltd. (TSX VENTURE:OLA) ("Orla" or the "Company") is pleased to provide an update on progress at its 100% owned Cerro Quema project in Panama and the closing of the Camino Rojo agreement with Goldcorp.

Cerro Quema

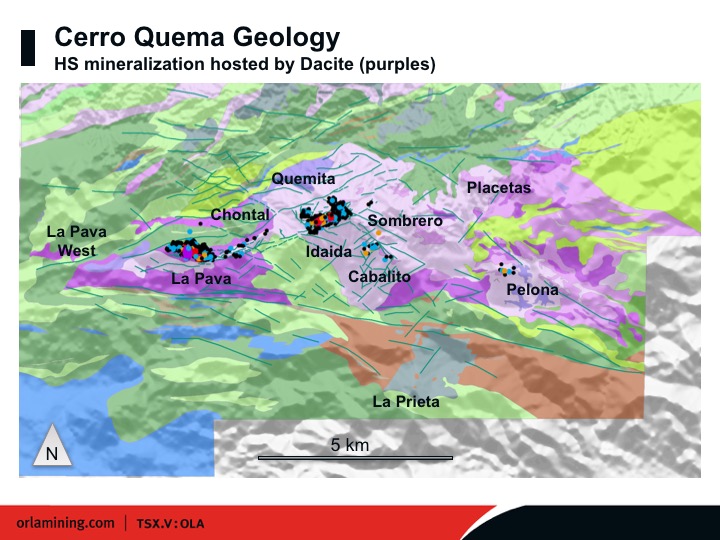

Exploration efforts at Quemita have been focused on discovering additional oxide material which could be accretive to the economics of the 488,000 ounce Cerro Quema oxide gold reserve (19.7 mT at 0.77 g/t Au - see 2014 N43-101 Technical Report on Orla website). Three drill rigs are on site testing various geological and geophysical targets. A total of 6,629 metres have been drilled in 56 holes in 2017 to date. All holes have intersected variably altered rock, including sections of vuggy silica and hydrothermal brecciation.

Encouraging results subsequent to a press release dated April 26, 2017 include two holes in the Quemita zone that intersected oxide material below the pit outline proposed in the 2014 Preliminary Feasibility Study (PFS). CQDH17-101 and CQDH17-103, drilled at different angles from the same pad, intersected 76.2m @ 0.45g/t and 89.0m @ 0.32 g/t Au respectively. These holes demonstrate that potentially economic gold values in oxide extend to depth below the current reserve. Follow-up holes are planned.

Hole CQDH17-115 intersected 84.8m @ 0.23 g/t gold 170 metres to the northeast of the Quemita proposed pit. The well oxidized material indicates potential for extending the pit outline to the east. Previously released results from hole CQDH17-068, (21.3 m @ 1.35 g/t Au), drilled 35 metres west of the proposed Quemita pit, similarly show potential for extension in that direction. Follow-up holes are planned in both areas.

A 47.8 metre intersection averaging 0.26 g/t Au in CQDH17-111 shows potential for oxide resource at the Idaida zone, 1.5 kilometres southeast of Quemita. Drilling is in progress in this area.

While the current exploration focus is on oxide material, work to test the potential for economic sulphide mineralization is also being conducted. While drilling, if mineralization is observed below the oxide-sulphide boundary, the holes are continued to fully test all mineralization. Copper intercepts thus far include 76.5m @ 0.87% Cu (+0.15 g/t Au) in CQDH17-112 north of the Quemita PFS pit and 66.0m @ 0.52% Cu (+0.24 g/t Au) in CQDH17-089 drilled in the Caballito area 2 kilometres to the southeast of Quemita.

Drilling is continuing, following-up on holes that show potential to increase the current oxide resource and testing remaining targets. The current work plan also includes metallurgical and other engineering studies required to update the economic analysis presented in the 2014 Pre-Feasibility Study. In addition to expansion of the zones that host the current reserve, potential sources of upside to the $110 million Net Present Value estimate in the PFS include opportunities to increase gold recovery and/or reduce operating costs. Estimates for these parameters will be revised based on a new geological model and results from column tests conducted at coarser crush sizes than previous testing.

A list of holes drilled in 2017 to date is appended to this release. Maps showing drill hole locations are available on the Company's website. (https://orlamining.com/projects/cerro-quema/maps)

A total of 72.7 line-kilometres of Induced Polarization (IP) and resistivity survey and 70.3 line-kilometres of magnetic survey were completed in March through June 2017. Geophysics was completed over 5 separate exploration targets. In addition, two reconnaissance lines were completed in an area with intrusive-hosted mineral potential. Resistivity anomalies outlined by the survey were interpreted to be due to silica associated with high sulphidation alteration. Anomalies drilled to date have confirmed this interpretation. Permitting to drill the rest of the resistivity anomalies is in progress. One of the reconnaissance lines over the area with potential intrusive hosted mineralization had a strong chargeability anomaly indicating the presence of sulphides. Follow-up work on this anomaly is planned.

Permitting and Mineral Concessions:

To develop a mine at Cerro Quema, a Category 3 environmental permit (ESIA) is required from the Ministry of Environment. An application for this permit was submitted in 2016. The Ministry has completed the technical evaluation of the ESIA and the Company believes the Ministry is in the process of preparing the formal resolution to approve it. Timing of approval is presently not known. When drilling commenced in January, it was in an area covered by previously issued permits. Since then, the Ministry of Environment has issued permits to drill three new areas.

Mineral concessions are comprised of three contracts between the Republic of Panama and Minera Cerro Quema S.A., a wholly owned subsidiary of Orla. The original 20-year term for these concessions expired on February 26 and March 3. The Company has applied for the prescribed 10-year extension to these contracts as it is entitled to under Panamanian mineral law. Orla believes it has complied with all legal requirements in relation to the concessions. On March 6, 2017, the Ministry of Commerce and Industry provided written confirmation to the Company that the extension applications were received and that exploration work could continue while the Company waits for the renewal. Management has also received verbal assurances from government officials that the renewal applications are complete with no outstanding legal issues. Furthermore, the Panamanian Ministry of Commerce and Industry approved the most recent annual report for the concessions which includes a work plan for 2017. On April 26, 2017, the Company received authorization from the Ministry of Environment to drill in two areas outside of the previously permitted drill area. On June 28, 2017, the Company received a permit to use water for drilling. A third drilling permit was received this month. The Company is actively engaged with government officials at various levels in regards to the ESIA and concession renewals. It is reviewing all options including ceasing site activities until such time as approval of the renewals and the permits is finalized.

Camino Rojo

On June 20, 2017, Orla entered into an asset purchase agreement with Goldcorp Inc. to acquire the Camino Rojo Project ("Camino Rojo"), a gold and silver oxide heap leach project containing 1.7 million ounces of gold reserves1 located in Zacatecas State, Central Mexico. All the mineral reserves and resources estimates described are historical estimates and Orla is not treating such estimates as current.

In addition, Orla and Goldcorp have agreed to enter into an option agreement regarding the potential future development of a sulphide operation at Camino Rojo whereby Goldcorp will, subject to the sulphide project meeting certain thresholds, have an option to acquire a 60% to 70% interest in such sulphide project at Camino Rojo.

Details of the transaction are described in the June 20, 2017 press release which can be found on the company's website.

Before closing the transaction, sometimes companies require clearance from the Mexican Federal Competition Commission ("COFECE"). An application to COFECE has been submitted and is currently being reviewed. The Ministry advises that this process takes between 60-90 days. Therefore, Orla anticipates that the transaction will close in October 2017.

Field work will commence as soon as the transaction is closed. Data compilation and analysis is underway. Results from the 375,000 metres of drilling will be used to develop a new geological model for the main area of known mineralization and facilitate an updated resource estimate. Existing metallurgical test work is being evaluated to see if additional tests are required before the Company initiates an economic analysis of a potential open pit mine and heap leach extraction facility. The project area has good access, proximity to power, and water permits have been granted. Importantly, Goldcorp developed excellent relations with the local Ejidos and land access agreements are in place.

Exploration data from the rest of the 206,000 hectare property is also being compiled. Once field work starts, Orla will build on the previous information to explore for other gold deposits in the prospective area.

Quality Control Protocols

All Au results were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver and copper, using an Aqua Regia (ME-ICP41) method at ALS Laboratories in Peru. Drill program design, Quality Assurance/Quality Control and interpretation of results are performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards, blanks and duplicates are included approximately one every 25 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. Approximately 5% of sample pulps are sent to a secondary laboratory for check assays. The HQ diameter core is halved with a diamond saw.

Qualified Person

The technical information in this news release has been reviewed and approved by Mr. Hans Smit, P.Geo., Chief Operating Officer of Orla Mining Ltd., who is the Qualified Person for the technical information in this news release under NI 43-101 standards.

1 Mineral Reserves and Resources estimate as reported by Goldcorp in its Annual Information Form dated March 16, 2017 ("AIF") for the financial year ended December 31, 2016, available to Canadian investors at www.sedar.com under Goldcorp's profile. Mineral Reserves and Mineral Resources were prepared by Goldcorp in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") under the supervision of a qualified person. The historical mineral reserve and resource estimates were estimated in accordance with the CIM Definition Standards and were calculated by Goldcorp using metal prices of $1,200 per gold ounce and $18 per silver ounce, and mineral resources were calculated using $1,400 per gold ounce, $20 per silver ounce, $1.00 per pound of lead and $1.00 per pound of zinc. A NI 43-101 Technical Report on Camino Rojo is available on SEDAR under the profile of Canplats Resources Corporation (acquired by Goldcorp in 2010). The last NI 43-101 Technical Report on Camino Rojo was produced on October 16, 2009 and amended on November 30, 2009. Orla is not treating these historical estimates as current and has not completed sufficient work to classify the historical estimate as current mineral reserves or mineral resources for Orla's purposes. Although Orla is not treating this information as current estimates, it believes the Goldcorp work is reliable and that the information, which was made publicly available by Goldcorp, may be of assistance to investors. The Company intends to review all project data, validate data quality, create a new geological model and then make an updated resource estimate in the upcoming months. As well, the Company will be reviewing metallurgical information and key economic parameters in order to evaluate the potential economics of an open pit gold and silver mine and heap leach extraction facility.

On behalf of the Board of Directors,

Marc Prefontaine, M.Sc., P.Geo., President & Chief Executive Officer

About Orla Mining Ltd.

Orla Mining is a mineral exploration company led by a group of seasoned mining executives with strong financial backing. The company's focus is to acquire mineral exploration opportunities where the Company's exploration and development expertise and corporate share structure could substantially enhance shareholder value. The 100% owned Cerro Quema project in Panama includes a near-term gold production scenario and significant exploration upside. Cerro Quema's 14,800 Ha concession boasts paved road access, a supportive local population and private land ownership. The Cerro Quema project is currently in the last stage of the permitting process for a proposed open pit mine and gold heap leach operation. Please refer to the Cerro Quema Project - Pre-Feasibility Study on the La Pava and Quemita Oxide Gold Deposits dated August 22, 2014, which is available on SEDAR.

Forward-looking Statements

This news release contains certain "forward-looking statements" within the meaning of Canadian and United States securities legislation, including, without limitation, statements with respect to the Company's objectives and strategies. Forward-looking statements are statements that are not historical facts which address events, results, outcomes or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Certain material assumptions regarding such forward-looking statements are discussed in this news release, including without limitation, assumptions that the Company's activities will be in accordance with the Company's public statements and stated goals; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of preliminary economic assessments, drill results and the estimation of mineral resources; and risks associated with executing the Company's objectives and strategies, including costs and expenses. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

| Cerro Quemo Drill Summary | ||||||||||||

| Aug 24 2017 | ||||||||||||

| Hole | Area | East | North | Elev | Az | Dip | Depth | Intercepts | ||||

| From | to | Width | Au g/t | Cu % | ||||||||

| CQDH-17-065 | Quemita | 553245 | 835709 | 817 | 184 | -50 | 101 | 13.9 | 21.0 | 7.1 | 0.48 | |

| CQDH-17-066 | Mesita | 552766 | 836042 | 673 | 22 | -60 | 89 | 43.2 | 46.9 | 3.7 | 0.31 | |

| CQDH-17-067 | Mesita | 552765 | 836040 | 673 | 199 | -60 | 125 | No sig int | ||||

| CQDH-17-068 | Quemita | 552842 | 835731 | 744 | 180 | -50 | 79 | 3.1 | 24.4 | 21.3 | 1.35 | |

| 40.5 | 47.9 | 7.4 | 0.302 | |||||||||

| CQDH-17-069 | Domo | 553331 | 836265 | 767 | 205 | -59 | 73 | 0.0 | 47.8 | 47.8 | 0.4715 | |

| CQDH-17-070 | Domo | 553331 | 836267 | 768 | 17 | -69 | 128 | 0.0 | 52.4 | 52.4 | 0.49 | |

| CQDH-17-071 | Quemita | 553320 | 835847 | 859 | 183 | -50 | 97 | 0.0 | 34.8 | 34.8 | 2.42 | |

| CQDH-17-072 | Quemita | 553393 | 835816 | 884 | 173 | -61 | 120 | 6.0 | 19.6 | 13.6 | 0.69 | |

| 56.2 | 100.4 | 44.2 | 0.3 | |||||||||

| CQDH-17-073 | Domo | 553374 | 836321 | 730 | 203 | -60 | 104 | No sig int | ||||

| CQDH-17-074 | Domo | 553376 | 836324 | 728 | 21 | -60 | 98 | 17.8 | 23.8 | 6.0 | 0.29 | |

| 55.3 | 58.5 | 3.2 | 0.69 | |||||||||

| CQDH-17-075 | Quemita | 553067 | 835718 | 852 | 179 | -50 | 76 | 0.0 | 42.3 | 42.3 | 3.5 | |

| CQDH-17-076 | Quemita | 553063 | 835758 | 851 | 179 | -58 | 93 | 0.0 | 63.5 | 63.5 | 1.37 | |

| including | 0.0 | 16.5 | 16.5 | 3.26 | ||||||||

| CQDH-17-077 | Quemita | 553020 | 835755 | 845 | 174 | -56 | 113 | 0.0 | 95.0 | 95.0 | 0.69 | |

| CQDH-17-078 | Quemita | 552971 | 835712 | 839 | 177 | -50 | 99 | 0.0 | 35.0 | 35.0 | 1.53 | |

| 47.0 | 61.0 | 14.0 | 1.17 | |||||||||

| CQDH-17-079 | Quemita | 553174 | 835793 | 815 | 179 | -56 | 120 | 19.4 | 83.5 | 64.1 | 0.65 | |

| CQDH-17-080 | Quemita | 553225 | 835754 | 831 | 115 | -61 | 117 | 57.6 | 71.7 | 14.1 | 0.48 | |

| CQDH-17-081 | Quemita | 553182 | 835708 | 829 | 119 | -49 | 131 | 23.6 | 54.0 | 30.4 | 0.7 | |

| 82.6 | 88.4 | 5.8 | 0.63 | |||||||||

| CQDH-17-082 | Quemita | 553216 | 835815 | 827 | 125 | -51 | 130 | No sig int | ||||

| CQDH-17-083 | Quemita | 553068 | 835560 | 779 | 182 | -51 | 116 | 30.2 | 33.2 | 3.0 | 1 | |

| CQDH-17-084 | Quemita | 553278 | 835895 | 825 | 127 | -51 | 101 | 0.0 | 4.0 | 4.0 | 0.71 | |

| CQDH-17-085 | Quemita | 552944 | 835502 | 795 | 323 | -53 | 127 | 24.5 | 126.5 | 102.0 | 0.17 | |

| including | 33.8 | 47.8 | 14.0 | 0.27 | ||||||||

| including | 100.8 | 107.1 | 6.3 | 0.42 | ||||||||

| CQDH-17-086 | Mesita | 552622 | 835944 | 661 | 193 | -89 | 103 | No sig int | ||||

| CQDH-17-087 | Mesita | 552630 | 836002 | 651 | 278 | -60 | 114 | 67.5 | 72.0 | 4.5 | 0.27 | |

| CQDH-17-088 | Mesita | 552622 | 835944 | 662 | 136 | -60 | 102 | No sig int | ||||

| CQDH-17-089 | Caballito | 554663 | 834771 | 663 | 2 | -62 | 101 | 0.0 | 22.0 | 22.0 | 0.38 | |

| 22.0 | 88.0 | 66.0 | 0.24 | 0.52 | ||||||||

| CQDH-17-090 | Mesita | 552633 | 836002 | 651 | 89 | -50 | 110 | 26.3 | 44.0 | 17.7 | 0.33 | |

| CQDH-17-091 | Quemita | 552851 | 835783 | 763 | 124 | -51 | 110 | No sig int | ||||

| CQDH-17-092 | Caballito | 554812 | 834847 | 762 | 354 | -61 | 104 | No sig int | ||||

| CQDH-17-093 | Mesita | 552690 | 836042 | 665 | 134 | -72 | 200 | 17.3 | 27.5 | 10.2 | 0.21 | |

| CQDH-17-094 | Quemita | 552849 | 835783 | 768 | 181 | -50 | 145 | 15.0 | 102.5 | 87.5 | 0.13 | |

| including | 50.9 | 61.3 | 10.4 | 0.25 | ||||||||

| CQDH-17-095 | Caballito | 554856 | 834792 | 754 | 358 | -62 | 78 | 53.6 | 56.0 | 2.4 | 0.57 | |

| CQDH-17-096 | Mesita | 552744 | 835954 | 708 | 133 | -60 | 115 | 0.0 | 32.0 | 32.0 | 0.27 | |

| CQDH-17-097 | Mesita | 552745 | 835952 | 706 | 311 | -60 | 99 | 0.0 | 4.5 | 4.5 | 0.37 | |

| CQDH-17-098 | Quemita | 553085 | 835796 | 825 | 179 | -60 | 111 | 0.0 | 82.9 | 82.9 | 0.51 | |

| CQDH-17-099 | Caballito | 554649 | 834732 | 668 | 356 | -61 | 107 | 44.0 | 68.5 | 24.5 | 0.33 | 0.89 |

| CQDH-17-100 | Mesita | 552512 | 835835 | 661 | 133 | -71 | 110 | 3.0 | 19.5 | 16.5 | 0.32 | |

| CQDH-17-101 | Quemita | 553066 | 835815 | 814 | 178 | -51 | 114 | 10.5 | 86.7 | 76.2 | 0.45 | |

| CQDH-17-102 | Mesita | 552512 | 835832 | 650 | 313 | -71 | 126 | 5.5 | 126.0 | 120.5 | 0.11 | |

| CQDH-17-103 | Quemita | 553066 | 835815 | 814 | 180 | -75 | 128 | 11.0 | 100.0 | 89.0 | 0.32 | |

| CQDH-17-104 | Caballito | 554634 | 834608 | 631 | 0 | -60 | 171 | 2.8 | 17.6 | 14.8 | 0.3 | |

| 115.9 | 126.6 | 10.7 | 1.69 | 1.32 | ||||||||

| including | 122.0 | 125.5 | 3.5 | 3.97 | 3.05 | |||||||

| CQDH-17-105 | Mesita | 552465 | 835943 | 624 | 135 | -70 | 117 | 15.0 | 29.4 | 14.4 | 0.3 | |

| CQDH-17-106 | Mesita | 552465 | 835944 | 629 | 315 | -70 | 104 | No sig int | ||||

| CQDH-17-107 | Quemita | 553077 | 835950 | 757 | 180 | -65 | 123 | No sig int | ||||

| CQDH-17-108 | Caballito | 554780 | 834750 | 711 | 0 | -60 | 101 | No sig int | ||||

| CQDH-17-109 | Quema - Bajo | 553266 | 836052 | 769 | 125 | -50 | 101 | No sig int | ||||

| CQDH-17-110 | Caballito | 554693 | 834691 | 663 | 0 | -60 | 102 | 12.2 | 15.6 | 3.4 | 0.26 | |

| CQDH-17-111 | Idaida | 554404 | 835089 | 756 | 320 | -50 | 167 | 7.7 | 55.5 | 47.8 | 0.26 | |

| 124.2 | 144.8 | 20.6 | 0.18 | 1.66 | ||||||||

| CQDH-17-112 | Quema - Bajo | 553185 | 836100 | 725 | 125 | -50 | 206 | 25.5 | 50.0 | 24.5 | 0.16 | 1.34 |

| 68.0 | 144.5 | 76.5 | 0.15 | 0.87 | ||||||||

| CQDH-17-113 | Caballito | 554540 | 834485 | 544 | 20 | -60 | 101 | 12.7 | 37.2 | 24.5 | 0.04 | 0.64 |

| CQDH-17-114 | Idaida | 554370 | 835125 | 736 | 320 | -50 | 101 | 35.2 | 78.5 | 43.3 | 0.42 | 0.69 |

| CQDH-17-115 | Quema - East | 553548 | 836123 | 854 | 319 | -61 | 122 | 3.0 | 87.8 | 84.8 | 0.23 | |

| CQDH-17-116 | Caballito | 554476 | 834623 | 583 | 246 | -57 | 330 | assays pending | ||||

| CQDH-17-117 | Quema | 553548 | 836123 | 854 | 140 | -50 | 108 | assays pending | ||||

| CQDH-17-118 | Idaida | 554353 | 835055 | 721 | 320 | -50 | 131 | assays pending | ||||

| CQDH-17-119 | Quema | 553429 | 835807 | 881 | 180 | -55 | 96 | assays pending | ||||

| CQDH-17-120 | Idaida | 554190 | 834936 | 614 | 225 | -60 | 141 | assays pending | ||||

| Total 2017 Drilling | 6629.4 | |||||||||||