Assets

Sulphide Project

Project Overview

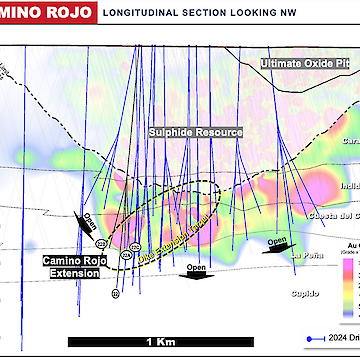

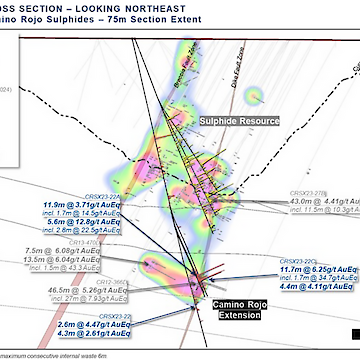

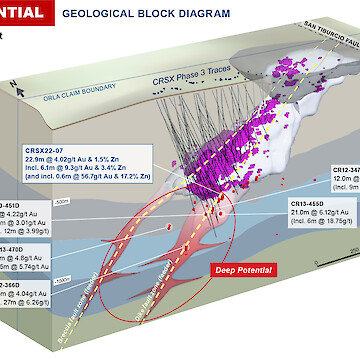

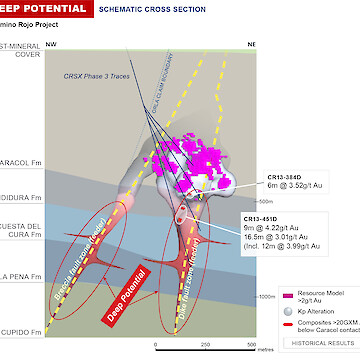

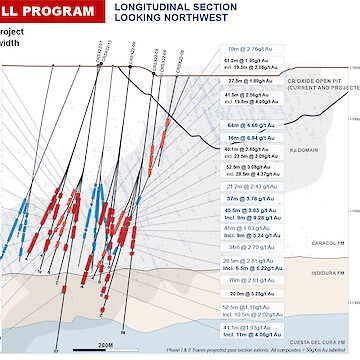

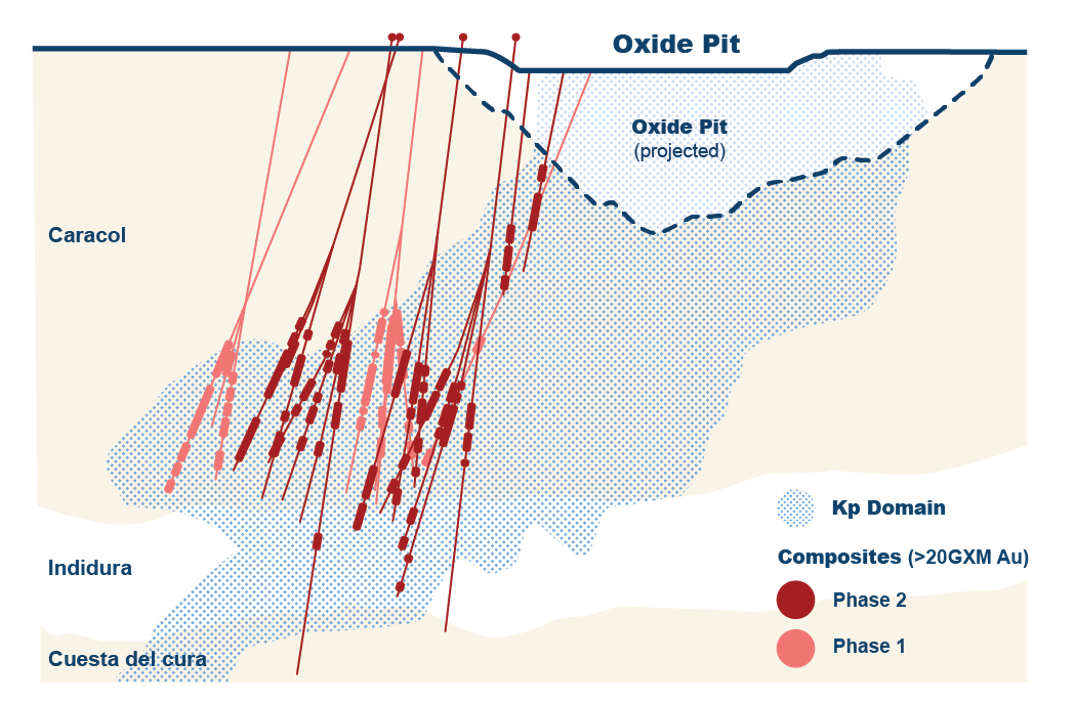

Below the Camino Rojo oxide reserve is a large, 7.3 Moz M&I gold sulphide resource. Multiple development scenarios are being considered and directional drilling continues into the resource to determine if an underground mining option with a standalone processing facility is possible. The underground drilling programs have thus far shown the presence of higher-grade zones over bulk mineable widths.

In 2023 Orla completed 37,677-metre drill program strategically focusing on infilling higher-grade parts of the Camino Rojo Sulphides deposit to support a potential underground Mineral Resource estimate, enhancing the understanding of geological controls of the deposit and extending some holes to explore for sulphide mineralization beyond the current Mineral Resource boundaries.

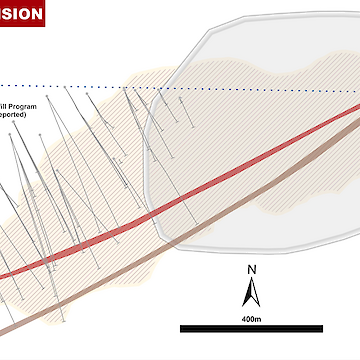

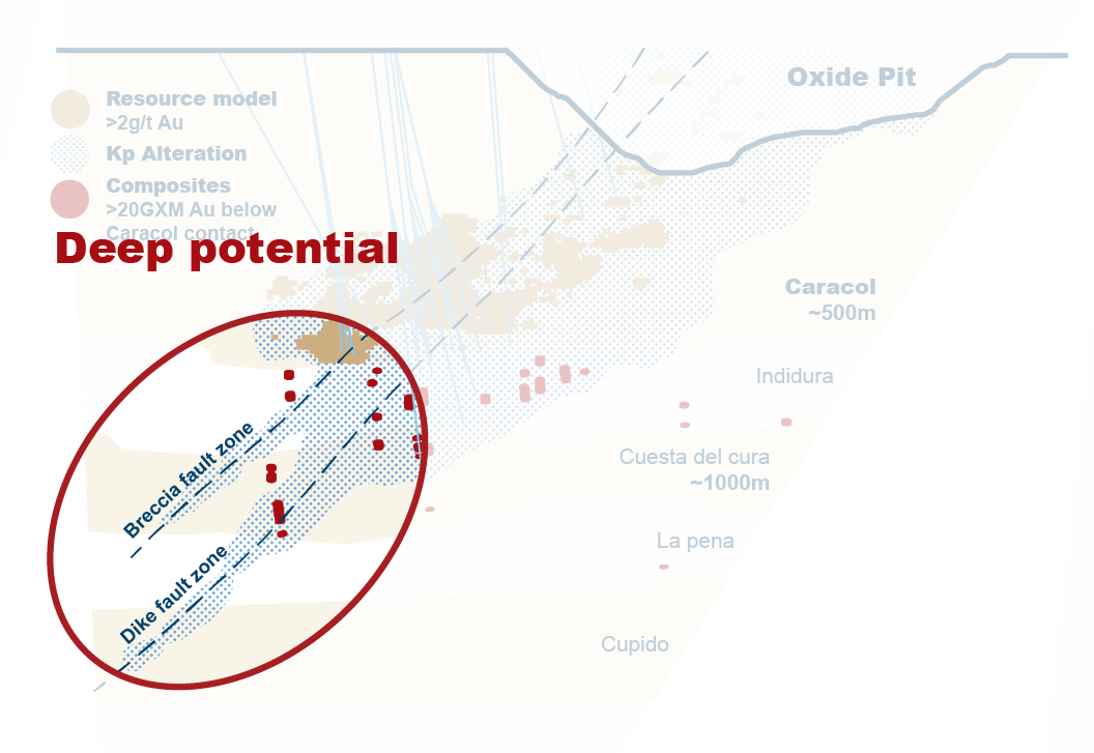

Orla has embarked on a 30,000m drill program in 2024 to test the deeper area beneath the Sulphide infill area, known as the “Camino Rojo Extension”. Initial drill results beneath the Caracol formation have revealed significant polymetallic semi-massive to massive sulphide mineralization.

Sulphide Project Update (Q1 2024)

In 2023, Orla undertook a 37,677-metre drill program, strategically focusing on infilling higher-grade parts of the Camino Rojo Sulphides deposit to support a potential underground Mineral Resource estimate. The primary objective was to enhance the understanding of geological controls of the deposit while extending selected drill holes to explore for sulphide mineralization beyond the current open pit Mineral Resource boundaries, referred to as the “Camino Rojo Extension.”

The current open pit mineral resource estimate for the Sulphides at Camino Rojo is 74 koz of measured resource (3.358 million tonnes at 0.69 g/t gold) and 7,221 koz of indicated resources (255.445 million tonnes at 0.88 g/t gold) with an effective date of June 7, 2019. A preliminary underground resource estimate on the Camino Rojo Sulphides is anticipated to be completed in the second half of 2024.

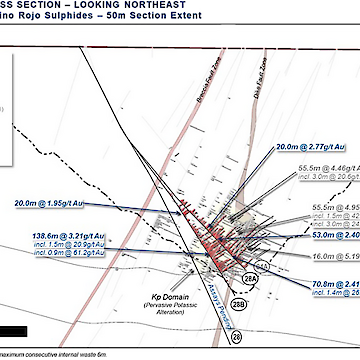

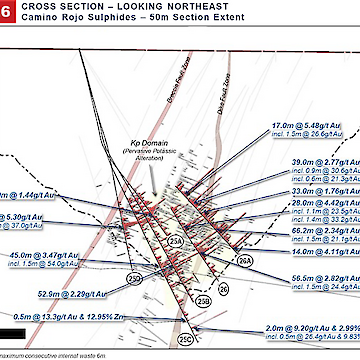

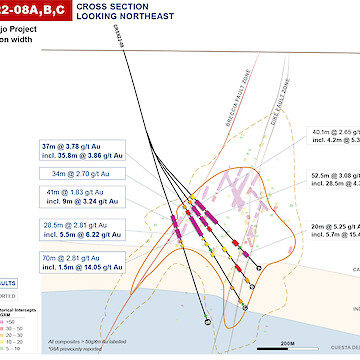

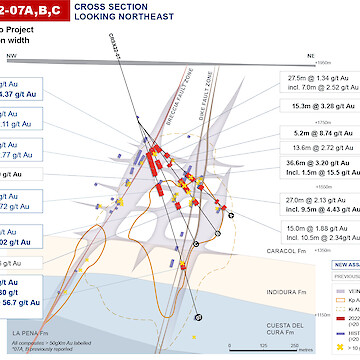

Sulphide Exploration

Overall, infill drilling of the Camino Rojo Sulphides has consistently yielded long intercepts (>30 metres down holes) of greater than 2.0 g/t Au. These significant drill results align with previous work, reinforcing the potential for an underground mining scenario. Recent drilling has returned notable high-grade intercepts exceeding 10 g/t Au over core lengths ranging from 0.7 metres to 3.0 metres. These high-grade intersections are part of wider intervals of greater than 2.0 g/t Au over tens of metres. The presence of high-grade gold results highlights the opportunity to enhance value through the potential implementation of more selective and targeted underground mining techniques.

Significant intercepts:

- CRSX23-20B: 2.22 g/t Au over 96.5 m, incl. 3.24 g/t Au over 33.9 m

- CRSX23-21A: 2.44 g/t Au over 49.5 m, incl. 4.59 g/t Au over 21.0 m

- CRSX23-23A: 3.41 g/t Au over 36m, incl. 29.2 g/t Au over 3.0 m

- CRSX23-24A: 2.94 g/t Au over 66.5 m, incl. 4.98 g/t Au over 16.5 m

- CRSX23-25D: 5.30 g/t Au over 20.5 m incl. 7.19 g/t Au over 14.5 m incl. 37.0 g/t Au over 1.4 m

- CRSX23-27B: 4.12 g/t Au over 43.0 m incl. 10.04 g/t Au over 11.5 m incl. 32.17 g/t over 2.0 m and incl. 14.45 g/t Au over 1.5 m

- CRSX23-28B: 3.21 g/t Au over 138.6 m incl. 9.15 g/t Au over 8.7 m incl. 11.4g/t Au over 1.45m and incl. 20.9g/t Au over 1.5 m and incl. 12.2g/t Au over 1.3 m

For full tables of drill results: January 2024; February 2024

Camino Rojo Extension

New Style of Sulphide Mineralization at Camino Rojo Extending 0.5km Beyond Current Resources

Historical and recent exploration drilling targeted lower stratigraphy, beneath the existing resources. In 2023, a drill section was completed 450 metres down-plunge from the current mineral resources and revealed significant intersections of high-grade polymetallic (Au-Ag-Zn) semi-massive to massive replacement-style mineralization. Recent drilling shows that the Camino Rojo mineral system extends beyond the current mineral resource envelope, presenting a considerable opportunity for resource expansion.

The 2023 Camino Rojo Extension drill program involved extending selected infill drillholes beyond the currently defined mineral resources and completing a down-plunge drill section to explore the distal extension into lower stratigraphy; 2,607 metres of drilling across four drill holes. Drill results have returned mineralized intercepts up to 450 metres down plunge of the existing open pit mineral resource boundaries.

Initial Metallurgy:

Orla completed an initial metallurgical testing program in 2023, using drill core material from holes CRSX22-07 and CRSX22-08C which intersected polymetallic replacement-style mineralization during the 2022 program. The metallurgical results on material from CRSX-22-07 and CRSX-22-08C were positive with high gold recovery reported in both CIL bottle roll tests between 81-96% and rougher flotation on the CRSX-22-07 material produced a gold concentrate with 85-88% gold recovery. Open-circuit zinc cleaner tests on material from CRSX-22-07 produced a zinc concentrate with zinc grades of 52% and over 85% zinc recovery. These results suggest this new style of mineralization may be amenable to both standard cyanide processing and flotation. Orla plans to further explore these promising results through additional metallurgical test work in 2024.

2024 Drill Program

The 2024 Camino Rojo Extension drill program commenced on January 9th with six drill rigs currently operational. This program is comprised of 15,000 metres dedicated to the dike extension target, focusing on the 500-metre spanning between the current mineral resource and the CRSX23-22 series of drill holes. An additional 15,000 metres are allocated to testing open mineralized trends and historical high-grade intersections, aiming to assess the broader potential of the growing Camino Rojo Deposit.

Significant intercepts:

- CRSX23-22C: 11.7m at 6.25g/t AuEq (4.86g/t Au, 44g/t Ag, 1.3% Zn)

- CRSX23-22A: 5.6m at 12.79g/t AuEq (10.3g/t Au, 38g/t Ag, 3.8% Zn)

- CRSX22-07: 22.9m at 4.98g/t AuEq (4.02g/t Au, 12g/t Ag, 1.5% Zn)

- CRSX23-15C: 8.5m at 5.96g/t AuEq (3.52g/t Au, 26g/t Ag, 3.6% Zn)

The following metal prices in USD were used for the gold metal equivalent calculations: $1,750/oz gold, $21/oz silver, $0.90/lb lead, $1.20/lb zinc, and $3.50/lb copper. Metal recoveries on the Sulphide Extension, based on the total recovery for the Resource estimate, were 86% for gold, 76% for silver, 60% for lead, and 64% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed to be 85% for copper. Metal recoveries on the Camino Rojo Extension, based on a preliminary metallurgical study, were 88% for gold and 92% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed to be 85% for silver, 85% for lead and 85% for copper.

The following equations were used to calculate gold equivalence:

Sulphide Extension AuEq = Au (g/t) + [ Ag (g/t) * 0.0106] + [ Pb (%) * 0.2460 ] + [ Zn (%) * 0.3499 ] + [ Cu (%) * 1.3555 ]

Camino Rojo Extension AuEq = Au (g/t) + [ Ag (g/t) * 0.0116] + [ Pb (%) * 0.3406 ] + [ Zn (%) * 0.4916 ] + [ Cu (%) * 1.3247 ]

Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for the recoveries used above.For full tables of drill results: Camino Rojo Extension February 2024

Sulphide Agreeement

Orla is the operator of the Camino Rojo Project and has full rights to explore, evaluate, and exploit the property. If a sulphide project is defined through a positive pre-feasibility study outlining one of the development scenarios: A or B below, Newmont may, at its option, enter into a joint venture for the purpose of future exploration, advancement, construction, and exploitation of the sulphide project.

Scenario A: A sulphide project where material from the Camino Rojo Project is processed using the existing infrastructure of the Peñasquito mine, mill, and concentrator facilities. In such a circumstance, the sulphide project would be operated by Newmont, who would earn a 70% interest in the sulphide project, with Orla owning 30%.

Scenario B: A standalone sulphide project with a mine plan containing at least 500 million tonnes of proven and probable mineral reserves using standalone facilities not associated with the Peñasquito mine. Under this scenario, the sulphide project would be operated by Newmont, who would earn a 60% interest in the sulphide project, with Orla owning 40%. Following the exercise of its option, if Newmont elects to sell its portion of the sulphide project, in whole or in part, then Orla would retain a right of first refusal on the sale of the sulphide project.

Camino Rojo Sulphide Gallery

[1] Additional information can be found in the Camino Rojo Technical Report entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” and dated January 11, 2021.

[2] Drill results presented are historical in nature. Such results were completed by Goldcorp Inc., a prior owner of the Camino Rojo Project. Composites for the sulphide drilling were calculated using 1 g/t Au cut-off grade and maximum 6 metres consecutive waste.

The mineral resource estimate for the Sulphide Project at Camino Rojo consists of 74 koz of measured resource (3.358 million tonnes at 0.69 g/t gold) and 7,221 koz of indicated resources (255.445 million tonnes at 0.88 g/t gold) and has an effective date of June 7, 2019. Additional information can be found in the Camino Rojo Technical Report entitled “Unconstrained Feasibility Study NI 43-101 Technical Report on the Camino Rojo Gold Project – Municipality of Mazapil, Zacatecas, Mexico” and dated January 11, 2021.